A remit payment, also known as a remittance, is money sent from one person to another, usually across international borders. It’s commonly used by migrant workers or expatriates to send money home to family members or dependents.

In simple terms, when you remit money, you’re transferring funds — either online, through banks, or via money transfer services — to support loved ones abroad. According to the World Bank, global remittances reached over $860 billion in 2024, showing how vital they are to families and economies around the world.

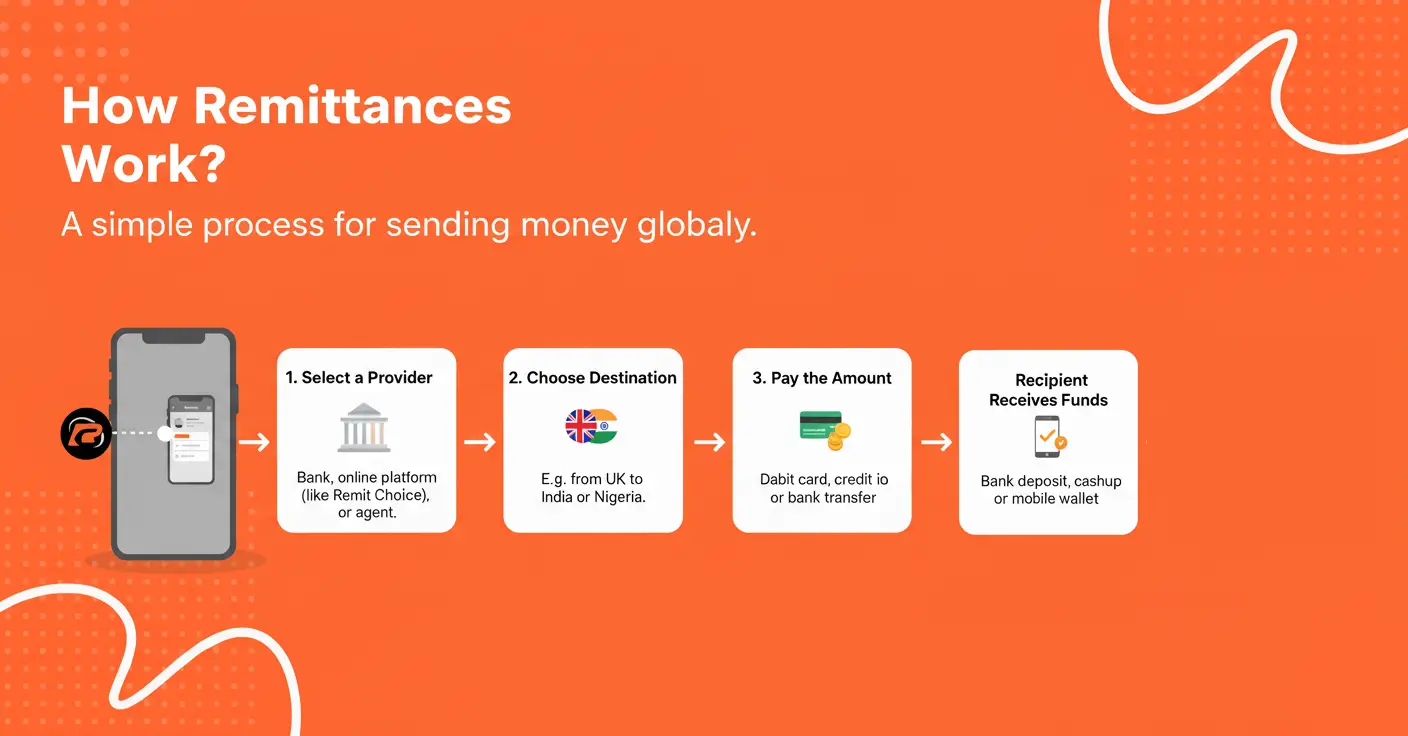

How Remittances Work?

When sending a remit payment, the process typically involves:

- Selecting a provider – This can be a bank, an online platform like Remit Choice, or a money transfer agent.

- Choosing a destination country – For example, sending money from the UK to India or Nigeria.

- Paying the amount – You can use a debit card, credit card, or bank transfer.

- Receiving funds – The recipient collects the money as a bank deposit, cash pickup, or mobile wallet credit.

Each transaction includes fees and an exchange rate margin, which together make up the total cost of your transfer.

For a clear comparison of global transfer costs, the World Bank’s Remittance Prices Worldwide tool offers up-to-date corridor data and insights.

How Much Does a Remit Payment Cost?

The cost of sending money abroad varies depending on:

- Destination country

- Transfer amount

- Service provider

- Payment and delivery methods

For example, sending money to Asia may have lower fees than transfers to Africa, depending on your provider. The IMF reports that global remittance costs average between 5% to 7% per transaction.

That’s why choosing a transparent provider with minimal hidden charges is essential.

Why Choose Remit Choice?

Remit Choice makes international money transfers fast, affordable, and secure. Customers can send money to 70+ countries — including India, Pakistan, Nigeria, and the Philippines — using an easy-to-use mobile app or website.

Key advantages include:

- No hidden fees – Transparent pricing and competitive exchange rates.

- Fast transfers – In many cases, funds arrive within minutes.

- Multiple payout options – Bank deposit, wallet credit, or cash pickup.

- Customer-focused service – 24/7 support for your transfer queries.

You can explore more about Remit Choice and their international corridors directly on their official website.

Is Sending Remittances Online Safe?

Yes — as long as you use a regulated provider. Trusted companies like Remit Choice comply with financial regulations and anti-fraud standards.

If you’re in the UK, you can verify whether a money transfer company is authorized using the Financial Conduct Authority’s (FCA) register.

To stay secure:

- Only send through verified platforms.

- Avoid sharing sensitive data on public Wi-Fi.

- Keep transaction receipts for reference.

How Long Does a Remit Payment Take?

Delivery time depends on:

- The sending and receiving countries

- Chosen payout method

- Day and time of transfer

Digital transfers using Remit Choice are often completed instantly or within hours, while some bank transfers may take 1–3 business days.

Frequently Asked Questions (FAQs)

- What is a remit payment?

A remit payment is the transfer of money from one country to another, often by an overseas worker to their family. - How can I send a remit payment easily?

You can use Remit Choice, a global remittance service that lets you send money to 70+ countries quickly and securely. - How much does it cost to send money abroad?

Fees depend on your provider and destination. You can check average remittance fees on the World Bank RPW website. - How do I know my transfer is safe?

Always use licensed services registered with regulatory bodies like the FCA. - Which countries can I send money to using Remit Choice?

Remit Choice supports transfers to over 70 countries, including India, Pakistan, Nigeria, Bangladesh, and the Philippines. - What’s the best time to send a remit payment?

Transfers are fastest during business hours in both sender and receiver countries, especially through digital platforms.

Conclusion

A remit payment is much more than just sending money — it’s about connecting families and supporting loved ones around the world. With Remit Choice, you can transfer funds safely, affordably, and quickly to over 70 countries.

For more information, explore Remit Choice or learn about global remittance trends on the World Bank’s remittance overview page.

[remit_app_cta]