Brokers charge clients finance broker fees to assist them get loans, mortgages, or investment portfolios. These people work as middlemen, linking customers with banks, lenders, or other financial institutions.

A loan broker saves you time and work, but you have to pay a charge for this service. Depending on the type of service, the amount of money involved, and the broker’s level of experience, these fees can be different.

Broker fees are typically worth it because of the value they bring, but you need to know how they work to avoid surprise charges.

[remit_app_cta]

Different Kinds of Finance Broker Fees You Should Know

Brokers use several ways to set their prices. Here are the most frequent sorts of fees that finance brokers charge:

Fees for Applying or Upfront

Some brokers charge a fee to start processing your application. This could include managing documents or doing a first look at the finances.

Fees Based on Commission

These are some of the most prevalent. When a trade is done, the broker gets a commission from the lender or institution.

Fees for Success and Performance

Some brokers only charge you if your application is approved or the deal goes through. This is called a “no win, no fee” contract.

Fees for Ongoing Service or Management

If you have long-term financial products with a broker, they may charge you ongoing service fees to keep your account up to date.

How to Figure Out How Much a Finance Broker Will Charge

Most of the time, finance broker fees are based on either a set rate or a percentage of the entire loan or investment amount.

- Fixed Fee: A set fee that is charged no matter how big the deal is.

- Percentage-Based Fee: Usually between 0.5% and 2% of the overall transaction.

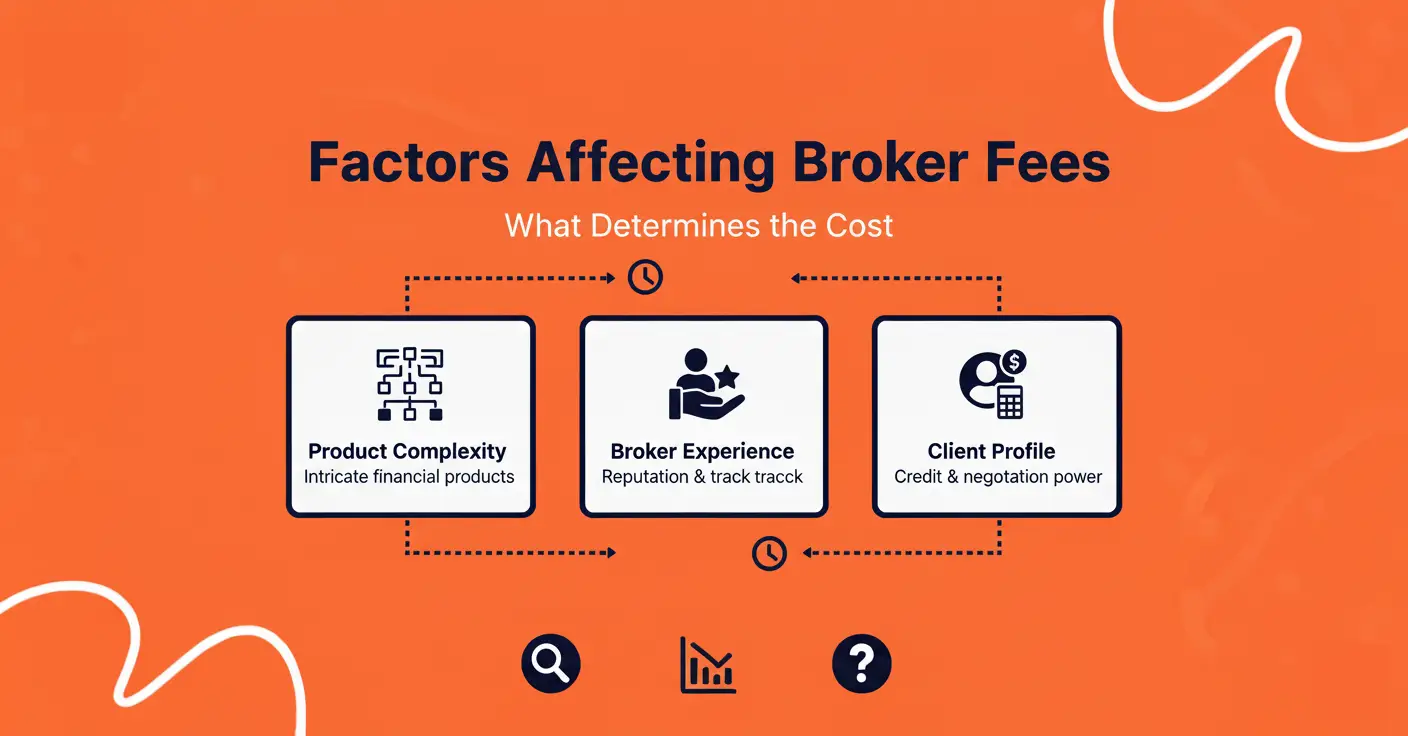

Things that affect broker fees are:

- How complicated the financial product is

- The broker’s experience and reputation

- Client’s credit profile and negotiation power

Costs That You Might Not See

Some brokers are honest, while others may impose modest fees for administrative work or penalties for paying off loans early. Before you sign, make sure you read your contract carefully.

Fees that aren’t obvious might pile up over time, especially when dealing with a lot of money or doing business across borders.

Comparing the Costs of Broker Services to Those of Direct Financial Services

It all comes down to what you want when you choose between a broker and direct financial services.

|

Option |

Pros | Cons |

| Using a Broker | Get expert guidance and access to several lenders | Extra fees and possible bias |

| Going Direct | Lower expenses and full control | Takes a long time and doesn’t let you compare many products |

If you like things to be clear and easy, services like Remit Choice enable you to send money over the world without paying hidden broker fees.

[remit_app_cta]

How Remit Choice Makes Things Easier — Sending Money Around the World

Remit Choice changes the way people send money to other countries. Brokers typically levy hidden costs, whereas Remit Choice has Transparent exchange rates and no hidden fees.

World Reach

You may send money to more than 70 countries right away with Remit Choice. This makes it a great choice for sending money.

Why Choose Remit Choice Instead of Regular Brokers

- No fees for services or brokerage

- Faster transfer speeds

- Customer service available 24/7

- Safe and in line with international compliance regulations

How to Lower or Avoid High Broker Fees

- Look at a few brokers before you choose one.

- If you can, try to negotiate the pricing structure.

- Use internet transfer services like Remit Choice to send money around the world directly and Affordably.

- Read the fine print to find hidden fees early.

Rules and Rights for Consumers Around Broker Fees

The UK Financial Conduct Authority (FCA) and other governments and financial authorities make sure that broker fees are clear.

Consumers have the right to demand transparent charge disclosures and report any unfair practices to regulatory organizations.

[remit_app_cta]

Questions That Are Often Asked (FAQs)

- Do all finance brokers impose fees?

Most brokers charge a fee, however others may get paid by lenders instead.

- Can you write off broker costs on your taxes?

Talk to a professional accountant to find out what the tax regulations are in your nation.

- How do I compare the fees that brokers charge?

Get written quotes and compare them next to each other.

- Can Remit Choice help me save money?

Yes. Remit Choice offers transparent transfers with no broker commissions.

- What will happen if I don’t pay a broker fee?

Your broker might not finish the job, or the contract could not be valid.

- Are online money transfer services safer than brokers?

Yes, if they are regulated. Remit Choice follows rules for international financial compliance.

Conclusion

Knowing how much financing brokers charge might help you make smart choices and save money. Whether you’re financing a property or sending money abroad, openness matters most.

Remit Choice is a good choice instead of traditional brokers because it has no hidden costs, affordable prices, and can send money to more than 70 countries.